Try This Genius Paypal G&s Fee Plan

페이지 정보

본문

Data associated with your account, comparable to Your name, tackle, e-mail address, and cost info. 2. Google Checkout permits storing addresses, credit and debit card info in its system and you do not have to retype all that knowledge every time. It provides advanced machine-studying fraud detection options and lets you customize your acceptable payment danger stage, so that you won’t miss out on gross sales that regular fraud monitoring tools would possibly rule as suspicious and block the transaction. Auction listings on eBay are active for one to 10 days, whereas buy-it-now or mounted-value gross sales don’t expire. PayPal provides higher cost choices for your prospects, reminiscent of Buy Now, Pay Later, PayPal Credit, and Pay Monthly, encouraging extra sales and increasing revenue. Both PayPal and Stripe also supply Buy Now, Pay Later options. Stripe presents a number of Buy Now, Pay Later options, like Afterpay. Stripe wins over PayPal on the subject of options. Real-time danger evaluation is also central to Stripe’s chargeback protection features. B2B companies that deal with giant volumes of international transactions will require a more subtle fraud detection system to minimize threat and provide maximum seller protection-and Stripe gives this. Affirm states that it evaluates transactions by considering numerous factors beyond just credit score scores, including the time of day and other nuanced details, to evaluate risk.

Data associated with your account, comparable to Your name, tackle, e-mail address, and cost info. 2. Google Checkout permits storing addresses, credit and debit card info in its system and you do not have to retype all that knowledge every time. It provides advanced machine-studying fraud detection options and lets you customize your acceptable payment danger stage, so that you won’t miss out on gross sales that regular fraud monitoring tools would possibly rule as suspicious and block the transaction. Auction listings on eBay are active for one to 10 days, whereas buy-it-now or mounted-value gross sales don’t expire. PayPal provides higher cost choices for your prospects, reminiscent of Buy Now, Pay Later, PayPal Credit, and Pay Monthly, encouraging extra sales and increasing revenue. Both PayPal and Stripe also supply Buy Now, Pay Later options. Stripe presents a number of Buy Now, Pay Later options, like Afterpay. Stripe wins over PayPal on the subject of options. Real-time danger evaluation is also central to Stripe’s chargeback protection features. B2B companies that deal with giant volumes of international transactions will require a more subtle fraud detection system to minimize threat and provide maximum seller protection-and Stripe gives this. Affirm states that it evaluates transactions by considering numerous factors beyond just credit score scores, including the time of day and other nuanced details, to evaluate risk.

Both Stripe and PayPal supply significant safety for online funds, however Stripe gives extra customization, together with identity verification. PayPal supplies seller safety for a vast variety of transactions, offered each transaction meets eligibility requirements. This ensures that your transactions are lined by PayPal’s Seller Protection policy. Stripe accepts ACH debit and credit score funds with fees starting from $1 to $5 per transaction, while PayPal’s echeck charges for invoices are 3.49% plus 49 cents, capped at $300. Stripe is the higher option if you want a more personalized cost solution for your corporation. They can be used for word processing and accessing enterprise related sites on the road, though their small screens and slower processors do not make them supreme for some enterprise uses. 9 cents. Stripe could present better charges for companies processing micropayments usually. It requires zero month-to-month fees and gives advanced cost processing and safety options you'll usually discover for bigger businesses. PayPal, nevertheless, offers broader buyer assist entry and lists 1000's of integrations for various capabilities. Its flat rate plus service price is barely more value-effective than PayPal, which prices $10 for recurring billing and an extra $30 for billing instruments, along with a gateway price.

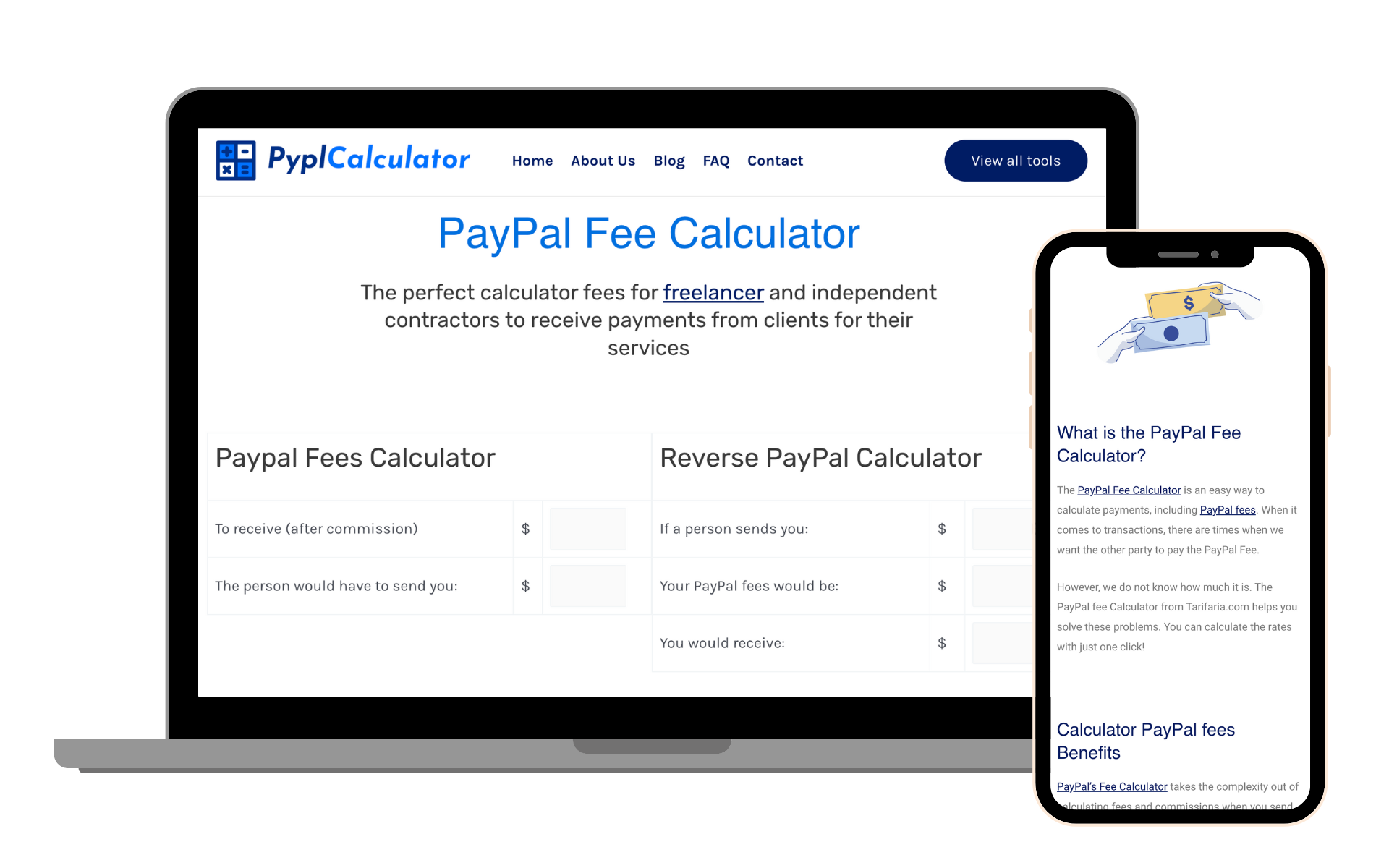

It has an lively vendor group that provides nearly every reply for using PayPal, along with access to customer service by way of textual content messaging and social media. It helps peer-to-peer transactions and offers handy access to funds. PayPal provides fee flexibility, with Venmo and cryptocurrency on its record. Venmo is mostly handled as a cell app, however you'll be able to access your account by means of a computer. Its tools, obtainable via the PayPal for Business app, facilitate simple creation and scheduling of professional invoices for recurring transactions on cellular units. Larry cargo bike to do supply routes and just lately a window cleansing and graffiti removing firm has started utilizing the same bike of their business. A cryptocurrency is considered legal tender by consensus and is secured by using cryptography based on mathematical formulation. Look as an alternative for a payment app particularly created for business customers, like Square Cash for Business or paypal calculator (though not the Friends and Family option). berechnung paypal gebühren permits you to create invoices from the PayPal for Business app.

For subscription-primarily based companies, Stripe Billing gives diverse fashions, customizable with features like coupons and free trials, robotically producing invoices upon plan selection. In case you ship out occasional local invoices and want echeck payments, PayPal is a person-friendly choice. 5% on every sale to construct something out with paypal. Okay thanks; I listed it on the market. While they both offer good security instruments and extensive integrations, Stripe affords better buyer support hours and extra sturdy developer tools. However, PayPal only provides prolonged cellphone assist hours in comparison with Stripe’s 24/7 help. Stripe affords 24/7 e-mail, telephone, and chat support. While it requires third-occasion integrations for ecommerce and multichannel tools, Stripe is extra flexible and customizable. Stripe stands out for its extensive integrations amongst fee processors, boasting plug-and-play compatibility with in style POS and ecommerce software program. He also started growing proprietary ecommerce tech. Developing a complete food delivery app requires multiple sections and functionalities to provide a clean user experience. Stripe’s hosted fee web page optimizes the checkout expertise for international customers. Stripe is miles forward with regards to online payment safety and has constructed a robust infrastructure for monitoring instruments to protect your transactions.

If you cherished this article and you would like to acquire a lot more details regarding paypal Calculator kindly visit our own web-page.

- 이전글5 Train Accident Cases Projects That Work For Any Budget 25.01.18

- 다음글Using TikTok Spark Ads: A Marketer’s Guide 25.01.18

댓글목록

등록된 댓글이 없습니다.